Your Guide to Harmonised System – The Universal Language of International Trade

The language of international trade

Every single day, millions of pounds worth of goods are traded from every corner of the world, goods from any sector, nature, and origin imaginable are shipped and traded amongst nations, sometimes neighboring countries, sometimes territories oceans apart.

With approximately 6,500 different languages spoken in the world and more than £19 trillion worth of goods traded every year amongst the world’s nations, how do businesses and customs authorities communicate? Through the universal language of International Trade, the Harmonised System.

In 1983, the World Customs Organization (WCO) recognized the importance of establishing a tool to help traders and regulatory authorities worldwide to communicate, execute control and regulate the goods being imported/exported into and out of their territories, as well as determine the applicable duties and product standards. In January 1988, this tool, known as the “Harmonised System (HS)” or “Commodity Code System” became a reality, it finally came into force, and it has been developed and governed by the WCO ever since. Currently, only 160 countries and the European Community have officially contracted the system, but more than 212 countries actively use the system to facilitate their everyday trading, this means that the Harmonised System is currently used to classify more than 98% of all international trade.

But what exactly is the Harmonised System?

The Commodity Code System is a multipurpose international product nomenclature system that was developed initially and primarily to help traders and customs authorities identifying the traded goods through a shared nomenclature system, hence removing unnecessary and somewhat invisible barriers to trading and speeding and facilitating the import and export process.

Through the years and as more countries continued to contract the nomenclature, the system expanded its reach and purposes and is nowadays used for other purposes just as important as the identification of the goods, such as: collection of trading statistics, monitoring controlled and dual use goods, identification of preferential and non-preferential origins, follow up trade negotiations (i.e. through tariff concessions), just to mention some of them.

In simpler words, the Harmonised System is a classification system in which every single product in existence is assigned an individual code, which is used by trading parties to avoid confusion that might be caused due to language or even marketing differences, let’s remember that even amongst English speaking nations there are language and cultural differences that could cause major delays in trade (i.e. a mobile in the UK is a cell phone in the USA), nevermind countries where both language and culture are completely different.

Here lies the importance of all businesses looking to explore foreign markets to become familiar with the Harmonised System and the tariff codes relevant to their traded goods, whether they are importing or exporting them.

How does the Harmonised System work?

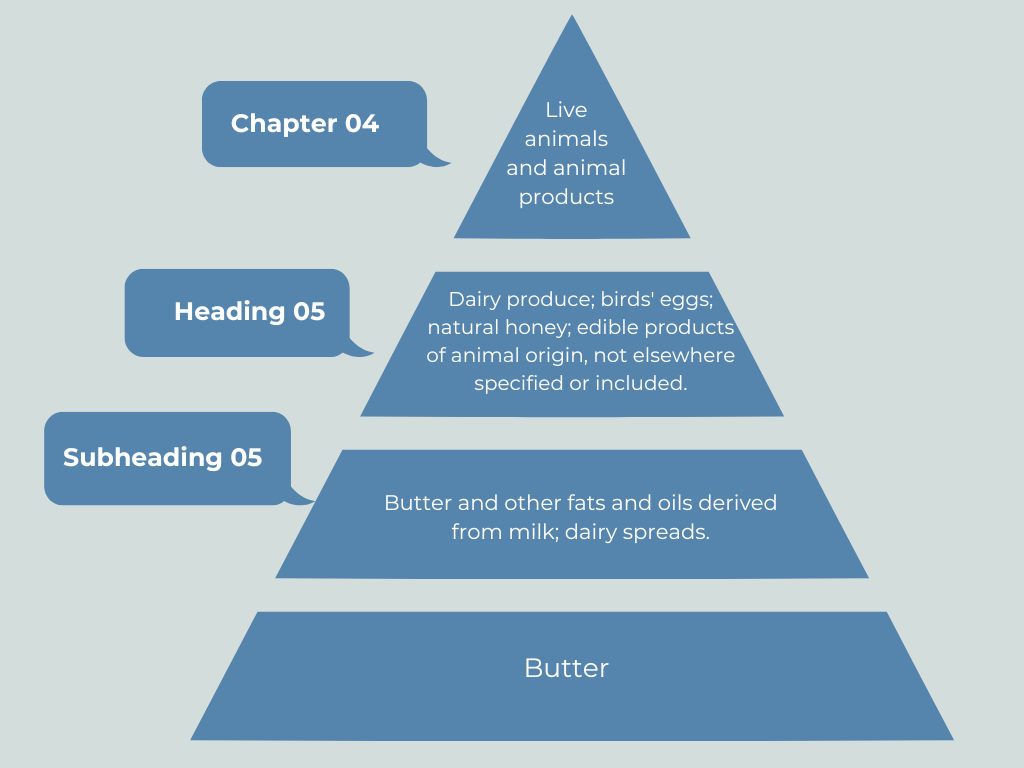

The system is arranged in a logical structure that allows us to uniformly classify all goods. This classification is organised by categories and subdivisions known as chapters, headings and subheadings, each represented by two-digit numbers that when put together form a six-digit set called “commodity code” or “tariff number” – these commodity codes are precisely what is used in International Trade to individually identify all existing goods in detail.

The Harmonised System is organised into 21 sections, 99 chapters, 1,244 headings and 5,224 subheadings, where the higher the number of digits in the commodity code the more detailed the category will be. As an example:

Although the codes are worldwide standard up to six digits, some countries apply further subdivisions to the Harmonised System expanding the commodity codes up to 8-10 digits long, this allows these countries to create their own national tariff lines, in which the first initial 6 digits will correspond to the official Harmonised System and be identical worldwide, but any further digits will be for local use only. In the UK for example, the national trade tariff comprises of 8 digits for exports and 10 digits for imports.

To classify goods traded with the UK as well as to determine what duties, taxes and restrictions will apply to the imported and exported goods, traders can use the UK Integrated Online Tariff Tool. This last information will also depend on the country of origin of the goods, please refer to our Learning Module: Rules of Origin – Key access to preferential duty rates for more information on this subject.

Why is it so important to get the classification right?

The Harmonised System has several different uses and benefits, but the one that correlates the most with traders is that of the accurate calculation of payable duties and taxes and any other applicable restrictions, such as anti-dumping duties, safeguarding measures, tariff quotas, licences required. The correct classification of the goods means the declaration made to customs authorities will be correct, the duties accurately paid and the trade compliant.

Declaring an incorrect tariff code can be perceived as lack of compliance and has severe consequences to the traders, from the retroactive recovery of any unpaid duties to the confiscation of the goods and high fines imposed to the trader of the goods, just to mention some of them.

Where can I get help?

Navigating the Harmonised System can be daunting for the nonexpert's eye, the system can be difficult to understand and master as it requires a certain level of specialization. For this reason, traders often rely on the assistance of experts to have their goods correctly classified. It is important to keep in mind and understand that the importer and exporter are each responsible for the correct classification and therefore customs declaration of the goods to the corresponding customs authorities, even if the goods were classified by a specialist or the declaration was submitted through a third party (i.e. customs agent).

There are several sources of support available, the UK Trade Tariff tool being the easiest to access; HMRC can also help traders with tariff classification through their classification support service. The London Chamber, through our Trusted Advisory service can also facilitate introductions to classification specialists, we also run a year-round training program that includes subjects that can help traders smoothly navigate the vast world of International Trade, such as the Understanding Commodity Codes training course. Finally, the WTO Online Tariff Facility is also a reliable source of information.

For more information or support, please visit the London Chamber website or email us at tradeenquiries@londonchamber.co.uk, we will be happy to assist you.

Prepared by: Elizabeth Skewes, Trade Services and Business Development Manager